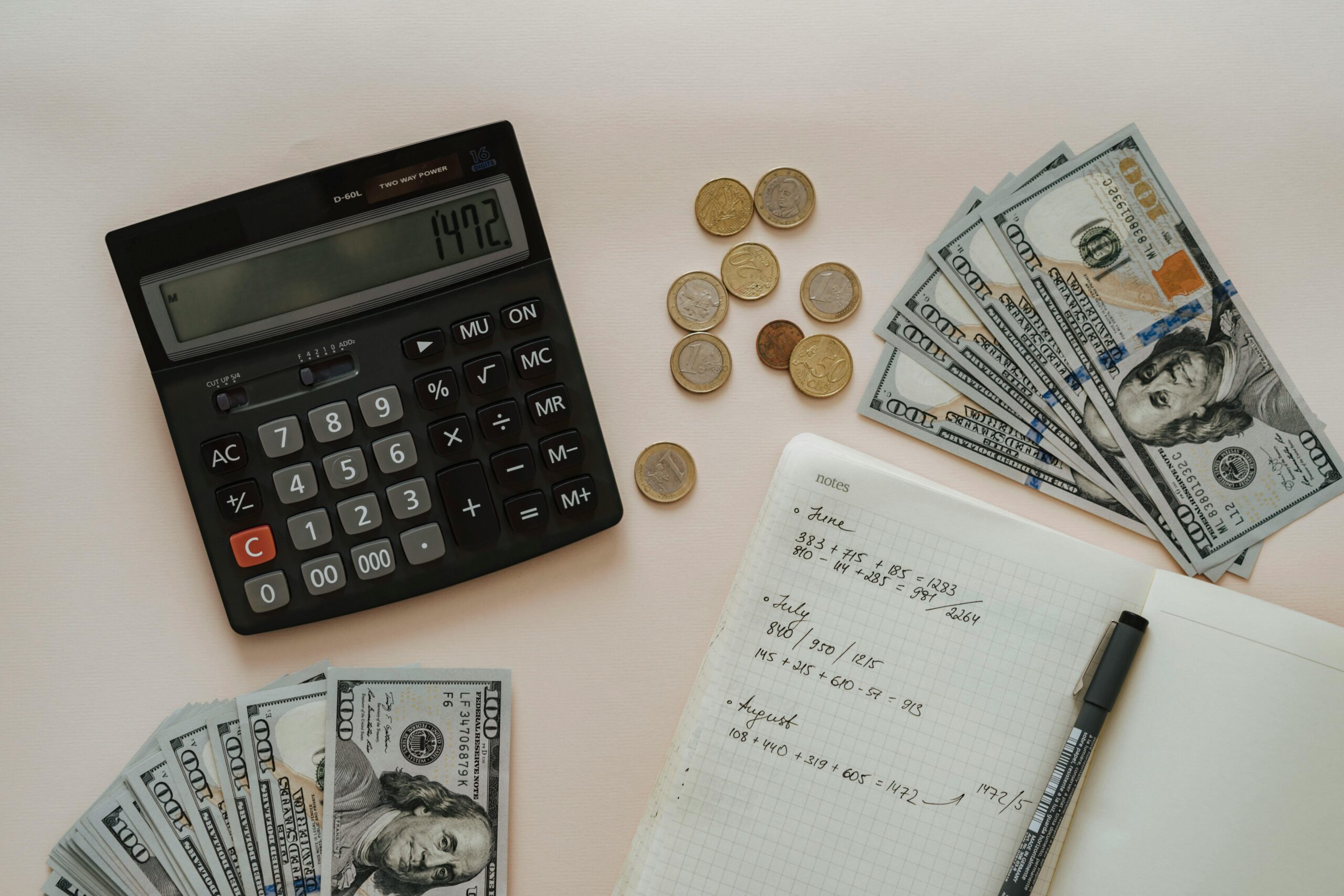

How COVID-19 Changed Our Financial Priorities — And Why You Need a Safety Net Now More Than Ever Like Emergency Funds

Why Emergency Funds Matter More Than Ever in 2025, being able to recover financially will be essential rather than optional. If the worldwide pandemic has taught us anything, it is that financial crises can happen at any time, and the biggest effects are frequently experienced by those who lack financial stability.

Since the COVID-19 pandemic, which left millions of people jobless, medically fragile, and unable to pay for necessities, the idea of an emergency fund—a savings reserve set aside for unforeseen life events—has gained popularity. The need for financial readiness has only grown as we enter the post-pandemic era due to factors including economic instability, growing living expenses, climate-related disasters, and the unpredictability of modern labour.

This article explores why emergency funds are more critical than ever in 2025, how they’ve helped individuals survive real crises, and what steps you can take today to build or strengthen your own.

The Evolution of Financial Awareness Post-COVID

Many people thought about emergency savings as optional or “something to think about later” prior to 2020. That view was completely altered by the COVID-19 epidemic. Overnight, businesses closed, employment disappeared, and governments all across the world enforced lockdowns. It served as a warning.

Nearly 78% of those who had an emergency fund during the pandemic described it as their main lifeline, according to a 2023 Deloitte financial readiness poll. Those without one, on the other hand, frequently had to rely on friends or family, get into debt, or worse, lose stability, home, and access to healthcare.

It was a stark reminder: an emergency fund isn’t just financial strategy — it’s survival.

What is an emergency fund exactly?

A separate pool of money set aside expressly to handle unexpected and abrupt needs is known as an emergency fund. These may consist of:

- Medical emergencies

- Job loss or salary cuts

- Urgent travel

- Home or car repairs

- Natural disasters

- Family emergencies

The majority of financial experts advise storing three to six months’ worth of necessities. However, many experts advise raising that range in 2025, particularly for independent contractors, small business owners, and people working in high-risk industries.

Real Stories: When Emergency Funds Made All the Difference

Maria’s Medical Emergency in Lahore

During the peak of the COVID-19 Delta wave, Maria, a 32-year-old Lahore freelance writer, developed a serious respiratory infection. She had to seek costly private care due to overcrowded public hospitals. Luckily, she had attended a personal finance lecture in 2019 and had been saving consistently since then. Her emergency money paid for PKR 500,000 in ICU bills.

“Without that money, I would’ve been completely helpless,” she recalls. “It literally saved my life.”

A Tech Worker’s Safety Net in Austin (Importance of Emergency Funds)

When the tech industry experienced a wave of layoffs in 2023, Jason, a software developer in Austin, Texas, experienced unexpected unemployment. He was on the verge of financial collapse with two children and a mortgage. But he had the time and space to retrain in machine learning thanks to a year’s worth of emergency funds. By early 2024, he had landed a higher-paying position.

“Jason claims that the emergency fund provided him with more than just cash. “It allowed me time to reflect, adjust, and develop.”

Flood Recovery in Rural Pakistan

In late 2022, a Southern Punjabi couple named Ahmed and Fatima lost their house due to severe flooding. To live, many people in their community were forced to rely only on loans or help. However, they were able to temporarily relocate, buy clean water, and make necessary repairs before help even came since they had been saving money for an emergency fund since the birth of their first kid.

Why Emergency Funds Are Essential in 2025

1. Economic Uncertainty Persists

In 2025, the state of the economy is still uncertain despite indications of a global revival. Risks include trade disputes, inflation, geopolitical unrest, and digital upheaval. A personal “shock absorber” against the volatility is an emergency fund.

2. Job Security is a Myth (Emergency Funds are important)

Traditional job security is becoming less common due to automation, AI integration, and the gig economy. More financial forethought is required for professions in contract labour, freelancing, and portfolio management. An emergency fund shields you from fluctuations in your income.

3. Medical Costs Keep Rising

Inflation in healthcare has not decreased. Even people with insurance frequently have to deal with co-payments, deductibles, or other out-of-pocket costs that might negatively affect their financial situation. These can be covered with a healthy emergency fund without compromising other necessities.

4. Climate Disasters Are Increasing

Whether its flash floods in Pakistan, wildfires in Canada, or heat waves in Europe, natural disasters are more frequent and more destructive. Emergency savings can help with relocation, repairs, and survival essentials — especially if aid is delayed.

5. Mental Health Benefits

It is impossible to overestimate the psychological comfort that comes with having a safety net. People who are financially secure tend to make better decisions, have healthier relationships, and experience less anxiety.

How Much Should You Save?

There is no one-size-fits-all solution in 2025. Your aim should be in line with your work kind, risk tolerance, and lifestyle.

| Category | Recommended Emergency Fund |

| Single, salaried individual | 3–4 months of expenses |

| Married, with dependents | 6–9 months of expenses |

| Freelancer/gig worker | 9–12 months of expenses |

| Living in disaster zones | 6–12 months of expenses |

| Elderly or chronically ill | 12 months or more |

Begin modestly. Over time, even a monthly savings of 5% to 10% of your salary can make a big difference.

Best Places to Park Your Emergency Fund

The most critical element is accessibility. Emergency funds shouldn’t be invested in long-term bonds, stocks, or real estate. Some of the options are:

- High-yield savings accounts

- Money market funds

- Digital bank wallets (like Sadapay or NayaPay in Pakistan)

- Short-term fixed deposits (with easy withdrawal)

Avoid temptation by keeping this account separate from your regular spending account.

Myths about Emergency Funds — Busted

• “My income is insufficient for saving.”

Even $10 or PKR 500 every week adds up. Begin someplace.

• “I’ll use my credit cards, which I have.”

A safety net is not debt. It causes further financial issues.

• “I will be covered by insurance.”

Exclusions, delays, and lost income are common features of insurance.

• “I can borrow from my relatives.”

Relying on others can be beneficial, but it can also weaken independence and damage relationships.

Steps to Build an Emergency Fund in 2025

1. Determine a reasonable savings goal based on your risk tolerance and lifestyle.

2. Create a different account just for emergencies.

3. Set up a monthly or paycheck-based savings account.

4. Put windfalls (tax refunds, bonuses) back into your fund.

5. Cut back on unnecessary spending and divide the difference.

6. Monitor your success using local apps like DigiKhata or budgeting tools like Mint or YNAB.

When Should You Use It?

Your emergency fund should be used only for genuine, unexpected emergencies:

- Job loss

- Urgent travel (illness or funerals)

- Medical bills

- Natural disaster expenses

Don’t use it for planned purchases, gadgets, or trips. Restocking should be your top priority as soon as your finances are stable.

Emergency Funds vs. Regular Savings

Regular savings and emergency money have different financial objectives. An emergency fund is intended for unforeseen circumstances such as essential repairs, job loss, or medical crises. It should not be utilized for investments or scheduled expenses, but rather held in a safe, easily accessible account. Regular saves, on the other hand, are for planned objectives like a vacation, a vehicle, or schooling.

Depending on your timeframe, you can invest these or put them in accounts that yield larger profits. Regular savings concentrate on growth and planning, whereas emergency reserves priorities security and liquidity. Combining the two can be dangerous since utilizing your emergency fund for non-essentials exposes you, while using savings for emergencies could cause you to lose sight of your objectives. Priorities building your emergency fund before making consistent contributions to your goal-based savings.

Final Thoughts

Above all, the post-COVID world has highlighted the fact that life is unpredictable. An emergency fund will provide you with breathing room in the event of an unforeseen circumstance, but it won’t fix every financial issue.

In 2025, having a sizeable emergency fund is essential for everyone, regardless of whether they are small business owners in Nairobi, paid workers in London, or gig workers in Karachi. Saving your future is more important than simply saving money.

Begin now. Every rupee, dollar, or pound you save is worth your peace of mind.

If you have any query contact us at subhanrajpoot1785283@gmail.com or visit https://www.financierwrite.com

Pingback: Why Many People Are Unaware of Financial Planning and How It Affects Their Future - financierwrite.com

Pingback: How to Save Money on a Low Income - financierwrite.com